The COVID-19 pandemic has been going for 18 months, affecting the incomes of many Canadians. In 2020, the federal government offered up CERB, Canada Emergency Relief Benefit, intended to provide support to people whose incomes were reduced due to public health orders.

According to Service Canada, the CERB, which is no longer available, was meant to provide temporary support to Canadians forced to stop working due to the pandemic.

But some of the seniors who applied for the benefit were in for a rude awakening in the summer of 2021 when they found their cheques were drastically reduced without warning. Pensioners are reporting that their already meagre monthly pension has been reduced from $200 to as much as $800 in the summer of 2021.

“How will older people survive with the clawbacks?” asked Alice Sam, an advocate for the homeless. “One lost her pension altogether. If she didn’t have a credit card she’d be screwed.”

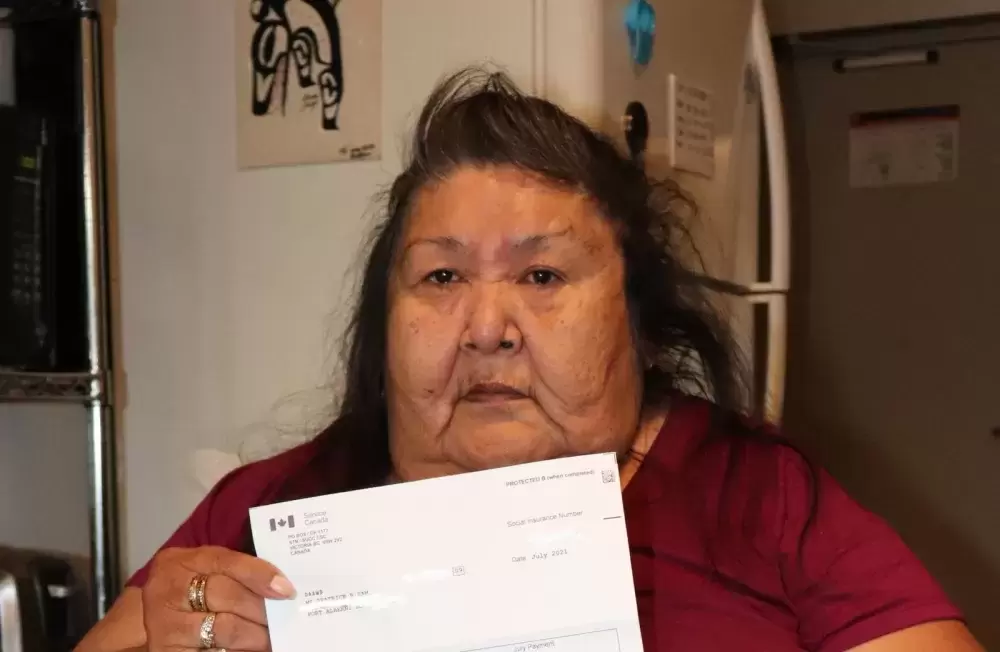

“I had $500 taken off of my pension last month,” said Ahousaht elder Beatrice Sam. Disabled, Sam lives in an independent living apartment at Tsawaayuus Rainbow Gardens in Port Alberni.

“I didn’t apply for CERB because I knew it would have to be paid back somehow,” said Beatrice.

But she thinks a CERB cheque was sent to her anyway. She can’t remember when she received the cheque, but she said the government docked her pension without telling her.

Beatrice says she makes do with what she has. She uses her pension to pay rent, utilities, phone, food, and car insurance. She buys in bulk, so she had something to fall back on when her pension cheque came in $500 short. But she won’t know if her next pension cheque will have deductions until she receives it on Monday, Sept. 27.

“It didn’t really affect me, but if it does, I will sell my crafts – trade bead necklaces,” said Beatrice.

Ahousaht elders Wally and Donna Samuel live in their own home in Port Alberni. They say they didn’t apply for the CERB.

“I knew they [the government] would try to get their money back – there’s always a catch,” said Wally.

Still, the couple heard there may be different reasons for the pension cutbacks.

“People need to monitor their accounts. We double-checked our account, and everything is still the same,” said Wally.

“This is scary for elders,” said Beatrice. “We don’t get much to begin with.”

According to Alice Sam, some elders think the deductions are due to settlements received for the Day School Class Action lawsuit.

Most don’t know because it is difficult for them to navigate the Canada Services information lines. Many elders are not literate in gadgets like computers and the internet. According to Alice Sam, one elder waited on the phone with Canada Pension Plan for six hours to ask why her payment was cut.

“After six hours she was told simply that it was because she received CERB,” Alice told Ha-Shilth-Sa.

“I know a woman who only has $89 left to live on,” Alice added. She said elders are afraid to speak out. “They are afraid of what can happen if they speak out. They are afraid it could get worse.”

Alice is worried that if these pension deductions continue, elders will lose their homes because they won’t be able to afford rent.

“I do a walk about maybe three times a week and noticed there’s at least 30 new people living on the streets and right now there are more elders on the street than we’ve ever had, homeless,” she said, adding that they’ve always been there but now it’s worse. “One woman applied for CERB to help make ends meet but now she lost her entire pension, and her rent is $1,200 a month.”

In Canada there are three main sources of government-provided retirement income: the Canada/Quebec Pension Plan (C/QPP), Old Age Security (OAS) - which is a fixed amount for most but does include a `clawback' of benefits for high-income individuals - and the Guaranteed Income Supplement (GIS), which is designed to help those with extremely low income.

The GIS is income-tested, meaning seniors must file their taxes annually and meet a certain income threshold to determine if they are eligible for the GIS benefit. If a retiree earns more income and rises above the GIS eligibility threshold, they could face a clawback of this benefit.

Changes in annual GIS payments occur in July and are based on the previous tax year.

GIS benefits are available to low-income seniors making less than $18, 984 annually. For couples, the maximum annual amount of income is $45,504.

By receiving the CERB, some seniors’ annual income may have risen above the maximum allowable income, resulting in GIS reductions beginning July 2021.

Ha-Shilth-Sa reached out to Services Canada with questions about why seniors have reduced or completely lost their GIS and how long the deductions will last but, with a federal election just completed, there have been no return calls or emails.

An advocate who works for the Port Alberni Friendship Center advises seniors to reach out to their elected officials, the MP and MLA, to get answers.