With the annual harvest a fraction of what it once was and a declining workforce, British Columbia’s forestry minister admits that the industry is in a state of transition – but needed changes won’t happen without participation of First Nations.

On Jan. 15 the Ministry of Forests announced a review of B.C. Timber Sales, the provincial agency that handles the sale of wood from Crown land. As BCTS manages 20 per cent of the province’s timber supply, the review seeks to find the potential for growth and diversification in an industry that has seen harvests shrink in recent years.

B.C.’ annual cut steadily increased over most of the 20th century until it peaked at almost 90 million cubic metres in 1987. This volume fluctuated over the following decades – but in recent years the annual harvest has dropped to as low as approximately 35 million cubic metres in 2023.

In a mandate letter from Premier David Eby given on Jan. 16, Forestry Minister Ravi Parmar received a directive to “enable harvest of 45 million cubic metres per year, while fulfilling our commitment to protect old growth.”

The review of BCTS hopes to find ways to diversify the manufacturing of value-added lumber, such as plywood, veneer and builder’s joinery.

“I think that we need to look at value over volume,” said Parmar in an interview on Dec. 18. “That’s going to be a big priority for me and a big priority for the forest services.”

In the past BC Timber Sales has at times been at odds with First Nations in whose territory the Crown timber is for sale. In 2014 a dispute over how the agency was managing cedar in the Nahmint Valley led the Tseshaht to blockade access to logging roads into the region south of Sproat Lake, and then more disagreements followed when BCTS sold timber from the valley without the First Nation’s consent. This long-standing dispute led to a $16.45-million settlement with the province that began last year, with incremental payments to the First Nation stretching into 2027.

Lennard Joe, CEO of the BC First Nations Forestry Council, is on an expert team assembled to help with the BCTS review.

“It is my hope that the outcome of the review leads to a stable and inclusive BCTS program that supports healthy ecosystems, a strong economy and vibrant communities, while fully respecting First Nations values and rights,” stated Joe.

“There is no future for forestry if there isn’t a role for First Nations,” said Parmar, who noted that Indigenous communities must be “at the table” and “strategic partners” for the industry to find opportunities.

B.C. forestry has seen a declining workforce, with jobs tied to the industry – including logging, manufacturing and supportive activities - falling from 56,085 in 2013 to 49,230 in 2023.

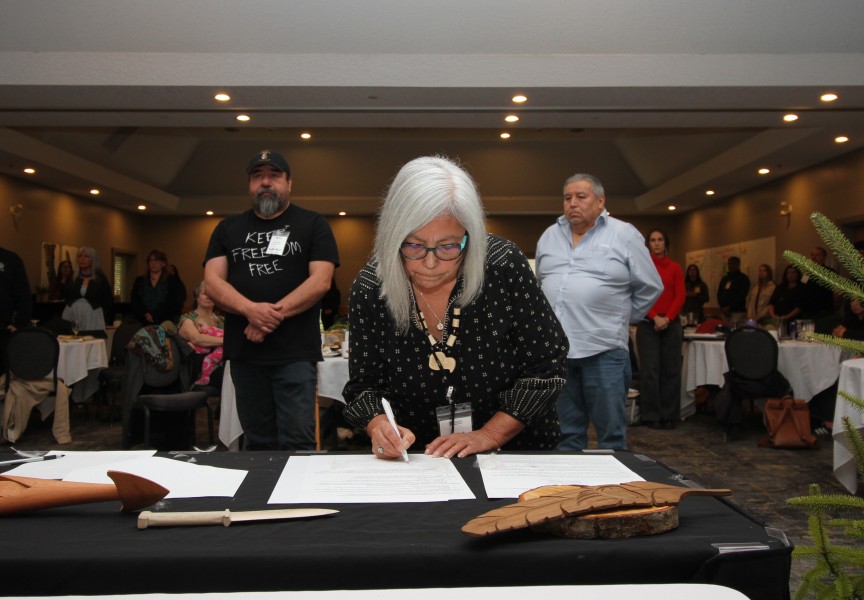

Meanwhile, many First Nations have claimed a larger stake in the sector, often taking the place previously held by longstanding logging companies. Last year the Ka:'yu:'k't'h'/Che:k'tles7et'h' First Nations finalised the $10-million purchase of a tenure in its territory from Interfor. The acquisition added 104,000 cubic metres to Tiičma Forestry’s annual allowable cut, multiplying the First Nation’s capacity to harvest in its ancestral lands.

Further south on Vancouver Island’s west coast, the Huu-ay-aht have grown its interests to make forestry account for most of the annual revenue generated by the First Nation’s group of businesses. HFN Forestry LP now manages four tenures, private lands, a woodlot licence, a community forest agreement, treaty settlement lands and a log sorting yard. Also notable is C̕awak ʔqin Forestry - a partnership between a Huu-ay-aht company and Western Forests Products - that manages TFL 44, a vast section of Crown land south of Port Alberni and Great Central Lake.

Much of the timber from this area was processed in Port Alberni, but what was once known as a mill town has been hit by a succession of facility closures over the past decade. Western Forest Products shut down its Somass sawmill in 2017, then the sprawling Alberni Pacific Division facility in 2022 – mills that specialized in cutting old growth that has become increasingly scarce.

Last October Port Alberni’s forestry suffered another blow when the San Group closed its facilities in the coastal city as it filed for creditor protection, putting over 100 people out of work. Based in Langley, B.C., the company arrived in Port Alberni in 2016 with a promise to do things differently by getting more value out of wood processed. San bought the former Coulsen mill south of Port Alberni, built a remanufacturing plant next to the Paper Excellence mill, and took over a whole berth at the city’s dockyards to ship oversees, riding on its accolade of being named B.C. Exporter of the Year in 2018.

But as of last year $22 million in stumpage fees were owed to the province, plus another $14 million to a long list of other creditors. San has blamed falling lumber prices, the lack of viable timber, the Highway 4 closure in the summer of 2023 and a province-wide port strike last July for its situation.

With Donald Trump set to take office this month, the province in bracing for the potential impacts of 25-per cent tariffs threatened by the United States’ president elect. Eby’s recent mandate letter to the forestry minister stressed how this could affect the industry.

“It’s a declaration of economic war, in my opinion,” said Eby during a Jan. 16 press conference. “This is a direct economic threat to B.C. families.”

At that media event Minster of Finance Brenda Bailey forecasted that B.C. would lose 124,000 jobs by 2028 if the 25 per cent US tax on imports from Canada take effect, with resource industries like forestry being primarily impacted. Currently 65 per cent of B.C.’s softwood lumber is exported to the United States, with another 20 per cent going to China, Japan, South Korea and India.